Fraud Surveillance Intelligence Compliance Oversight Unit 3286965186 3295353086 3384800703 3756232303 3510077494 3516659907

The Fraud Surveillance Intelligence Compliance Oversight Unit is pivotal in maintaining the integrity of financial institutions. Its key functions include monitoring transactions and enforcing compliance with regulatory standards. By implementing effective fraud prevention strategies, the unit safeguards consumer assets. However, the continual evolution of fraud tactics poses significant challenges. Understanding how this unit adapts to these challenges reveals deeper insights into the security of financial transactions and the mechanisms that foster consumer trust.

The Importance of Fraud Surveillance in Financial Institutions

Although financial institutions are integral to the economy, they are also prime targets for fraudulent activities, necessitating robust fraud surveillance systems.

Understanding current fraud trends is crucial for developing effective detection techniques. By employing advanced analytics and machine learning, institutions can identify suspicious patterns and mitigate risks, ultimately safeguarding assets and maintaining consumer trust in a landscape increasingly fraught with financial deception.

Key Functions of the Fraud Surveillance Intelligence Compliance Oversight Unit

The Fraud Surveillance Intelligence Compliance Oversight Unit plays a critical role in ensuring the integrity and security of financial operations.

Its key functions include implementing fraud prevention strategies and conducting compliance training to equip staff with essential knowledge.

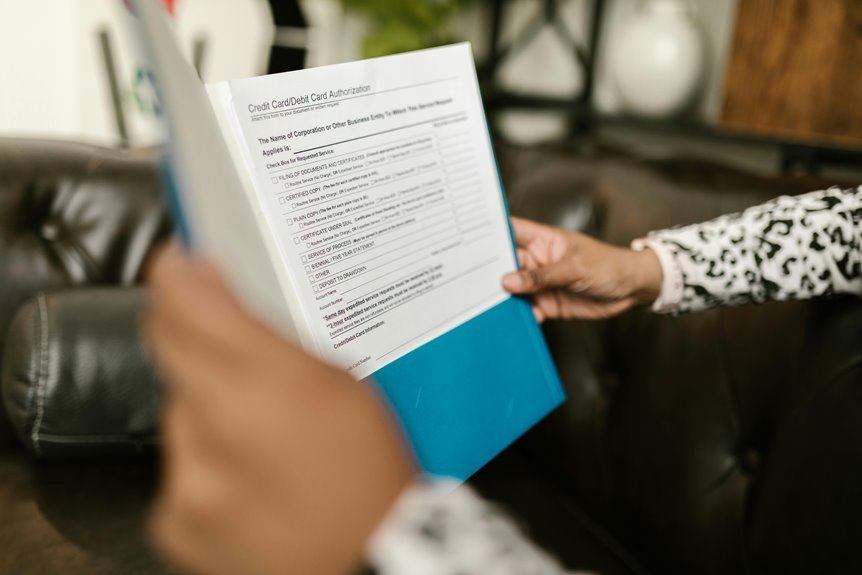

Regulatory Standards and Compliance Measures

As organizations navigate the complexities of financial transactions, adherence to regulatory standards and compliance measures becomes paramount to mitigating risks associated with fraud.

Regulatory frameworks establish guidelines that dictate the necessary processes for compliance audits, ensuring organizations maintain financial integrity.

The Impact of Fraud Detection on Consumer Protection

While financial fraud continues to evolve in complexity, the effectiveness of fraud detection systems plays a crucial role in enhancing consumer protection.

Implementing robust fraud prevention strategies not only mitigates risks but also fosters consumer trust enhancement. As consumers gain confidence in the security of their transactions, they are more likely to engage freely, ultimately benefiting the financial ecosystem through increased participation and loyalty.

Conclusion

In conclusion, the Fraud Surveillance Intelligence Compliance Oversight Unit serves as an impenetrable fortress against the relentless tide of financial fraud, safeguarding institutions and consumers alike. Its key functions and adherence to regulatory standards not only enhance compliance and detection capabilities but also build an environment of trust within the financial ecosystem. By continuously evolving with emerging fraud trends, the unit plays a pivotal role in protecting consumer assets and promoting secure transactional engagement across the industry.