57665500 Short-Call Density Across Demographics

Short-call density exhibits notable variation among different demographic groups. Age, income, and geographic factors significantly influence trading behaviors. Younger investors often pursue speculative strategies, while older individuals prioritize risk management. Income disparities further impact risk appetite, with wealthier traders more inclined to engage in aggressive tactics. Urban centers show heightened activity due to better resource access. Understanding these dynamics is crucial for developing effective trading strategies tailored to specific demographic segments. What implications might these trends have for future market behavior?

Understanding Short-Call Density: A Demographic Overview

Short-call density, a critical metric in the analysis of telecommunications behavior, varies significantly across diverse demographic groups.

This variation reflects differing short call motivations influenced by factors such as lifestyle and trading psychology. Individuals exhibit unique preferences in communication patterns, which subsequently shape their engagement levels.

Understanding these dynamics is essential for tailoring strategies that resonate with the nuanced needs of each demographic segment.

Age-Based Trends in Short-Call Strategies

How do age-related factors influence short-call strategies among different demographics?

Younger investors often exhibit higher youth engagement, utilizing short-call strategies for speculative gains.

In contrast, older demographics tend to favor conservative retirement strategies, focusing on risk management and income generation.

This divergence highlights how age shapes trading preferences, reflecting varying priorities and risk tolerances across the spectrum of investors.

Income Levels and Their Influence on Trading Behavior

Income levels significantly shape trading behavior, influencing the strategies investors adopt in the market.

Those with higher income often exhibit confidence in risk-taking, while lower-income individuals may display cautious trading psychology due to income disparity.

This divergence in approach reflects varying access to resources and information, ultimately affecting decision-making and market engagement.

Understanding these dynamics is crucial for analyzing trading patterns across demographics.

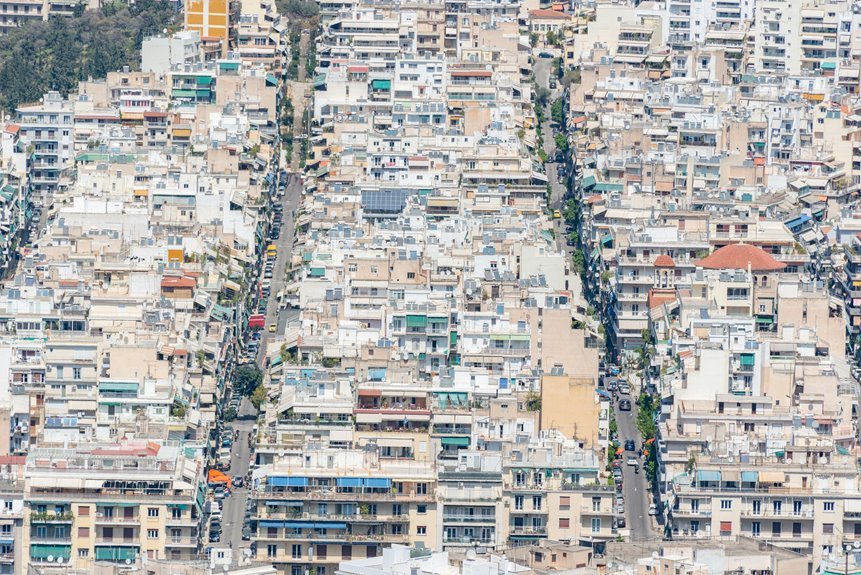

Geographic Variations in Short-Call Engagement

Geographic location plays a significant role in shaping short-call engagement among investors.

Urban areas exhibit higher short-call activity due to greater access to financial resources and information, while rural regions tend to show lower engagement levels.

Regional preferences also influence trading strategies, with urban investors often favoring more aggressive tactics, contrasting with the conservative approaches more common in rural markets.

Conclusion

In conclusion, short-call density reveals a complex tapestry woven from demographic threads, highlighting distinct patterns influenced by age, income, and geography. Younger investors, like budding entrepreneurs, often chase speculative gains, while older individuals adopt a more cautious stance. Income disparities further accentuate this divide, with wealthier traders more willing to embrace risk. Urban centers, bustling with opportunity, amplify short-call activity, underscoring the necessity for tailored trading strategies that resonate with the unique characteristics of each demographic.